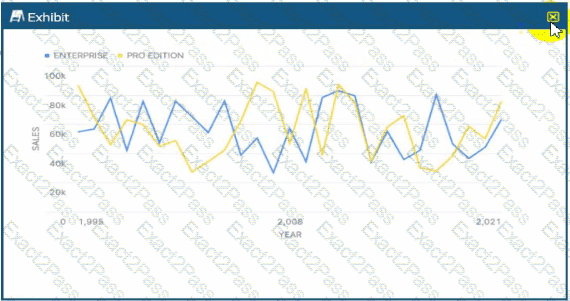

In Data Analysis, correlation refers to a statistical relationship between two variables. When analyzing a time-series chart like the one provided, a Data Analyst looks for patterns in how the two categories—"Enterprise" (blue line) and "Pro Edition" (yellow line)—move in relation to one another over the X-axis (Year).

A Positive Correlation would be indicated if both lines generally moved in the same direction at the same time (e.g., when Enterprise sales increase, Pro Edition sales also increase). A Negative Correlation (or inverse correlation) would be shown if the lines moved in opposite directions consistently (e.g., when one peaks, the other troughs).

Looking closely at the provided exhibit, the fluctuations for both editions are highly erratic and appear independent of each other. For instance, around the year 2008, the Pro Edition (yellow) shows a significant peak while the Enterprise edition (blue) experiences a sharp decline. Conversely, in other sections of the chart, they both dip or rise simultaneously by chance, but there is no sustained, predictable pattern of movement. The peaks and valleys do not align in a way that suggests one variable's movement is tied to the other.

Statistically, this lack of a discernible relationship indicates a Correlation Coefficient near zero. In the context of the Snowflake Snowpro Advanced: Data Analyst exam, identifying "No Correlation" is a key skill for interpreting Snowsight visualizations. It tells the analyst that the factors driving sales for the Enterprise tier are likely distinct from those driving the Pro Edition, and they should be analyzed as independent segments rather than interdependent variables. Therefore, based on the visual evidence of random, non-synchronous movement across the timeline, the only supported conclusion is that there is no correlation.