Last Update 21 hours ago Total Questions : 145

The Fundamental Payroll Certification content is now fully updated, with all current exam questions added 21 hours ago. Deciding to include FPC-Remote practice exam questions in your study plan goes far beyond basic test preparation.

You'll find that our FPC-Remote exam questions frequently feature detailed scenarios and practical problem-solving exercises that directly mirror industry challenges. Engaging with these FPC-Remote sample sets allows you to effectively manage your time and pace yourself, giving you the ability to finish any Fundamental Payroll Certification practice test comfortably within the allotted time.

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of:

Which of the following statements is TRUE regarding the pre-notification process?

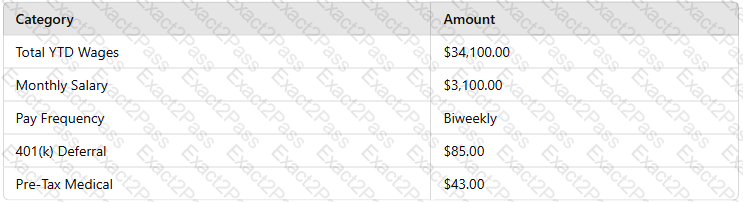

Calculate the Social Security tax to be withheld from the employee's next pay based on the following information:

All of the following elements are part of the control process EXCEPT:

To identify an out-of-balance general ledger account, all of the following documents should be used EXCEPT:

A company has engaged an individual to write a sales contract. The individual receives a flat amount for the task and has an assigned time frame for completion. This individual is classified as a(n):

An employee receives a total of $200.10 in cash tips in July. Determine the latest date the employee MUST report tip income to the employer.