Output image

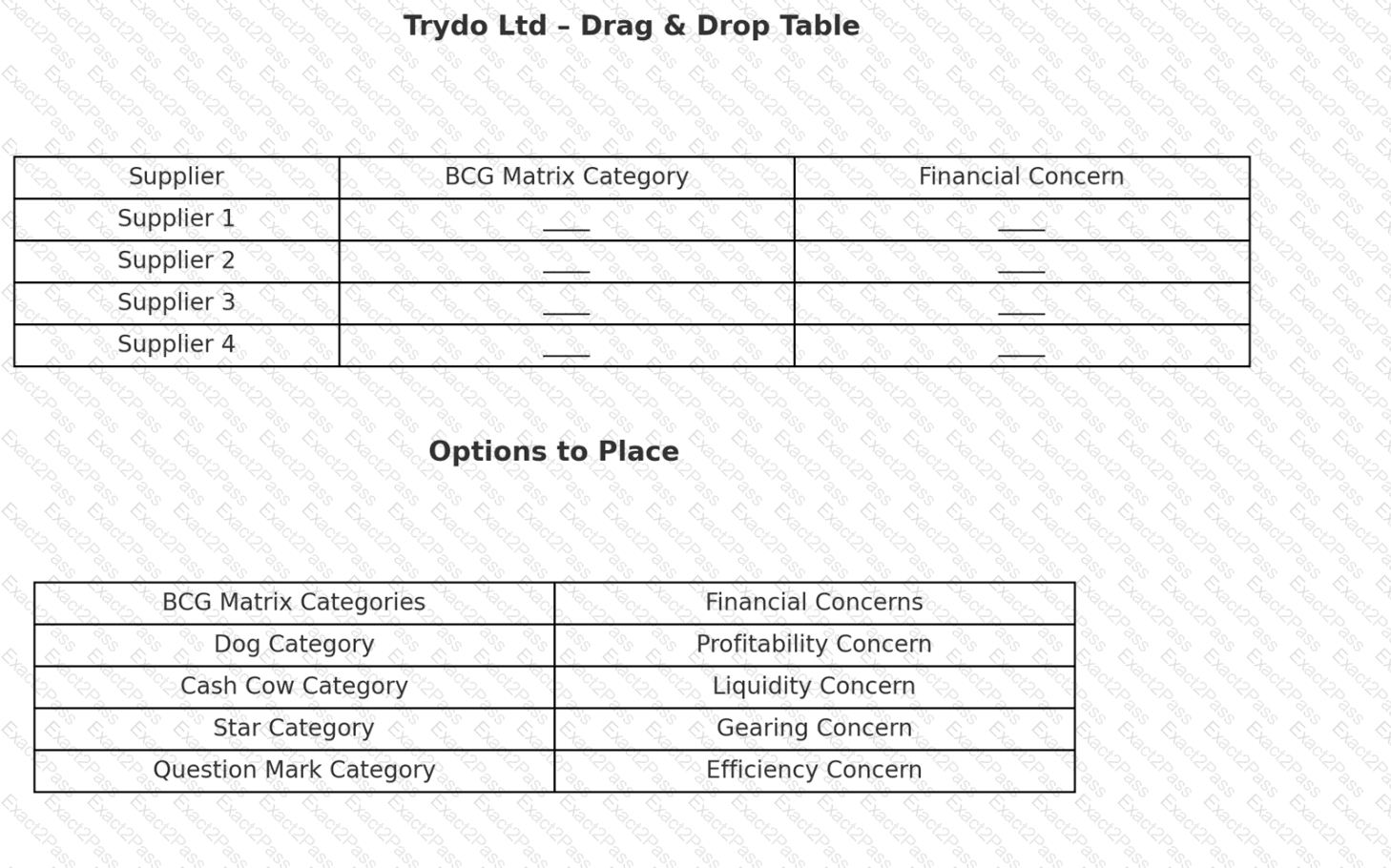

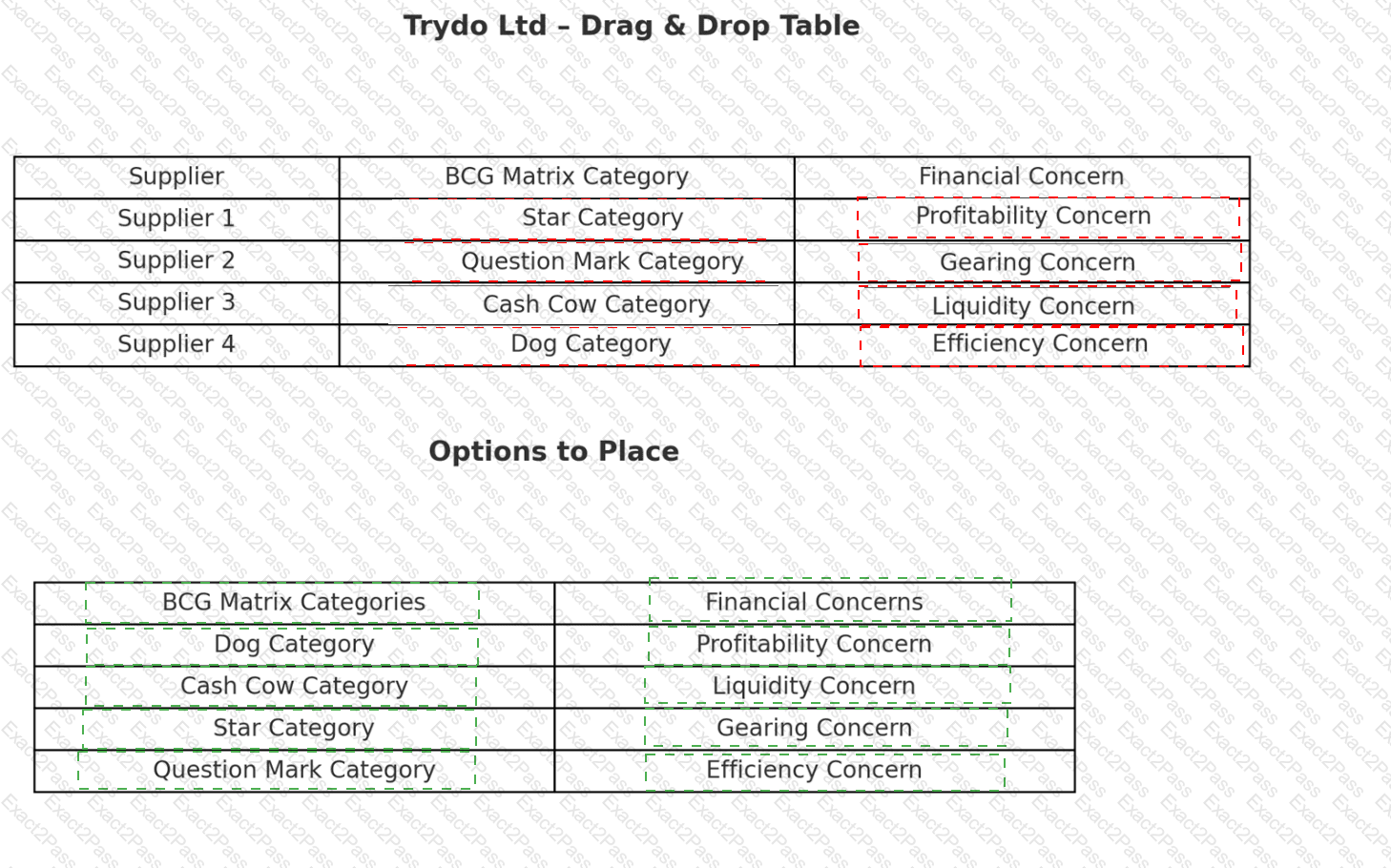

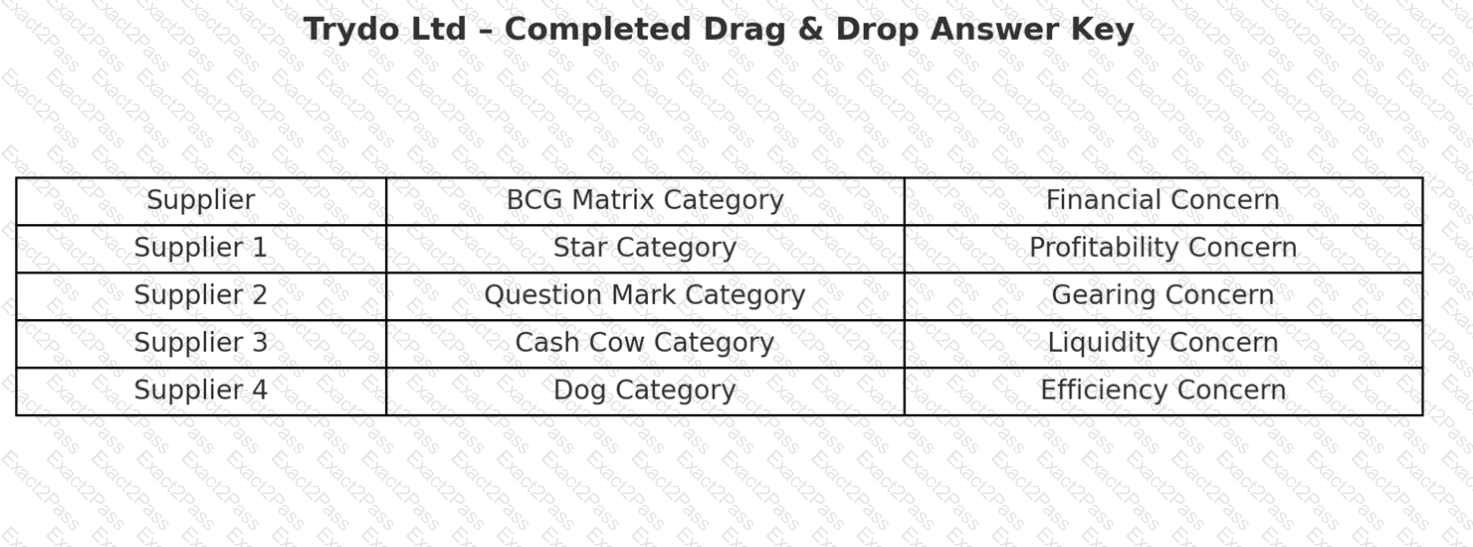

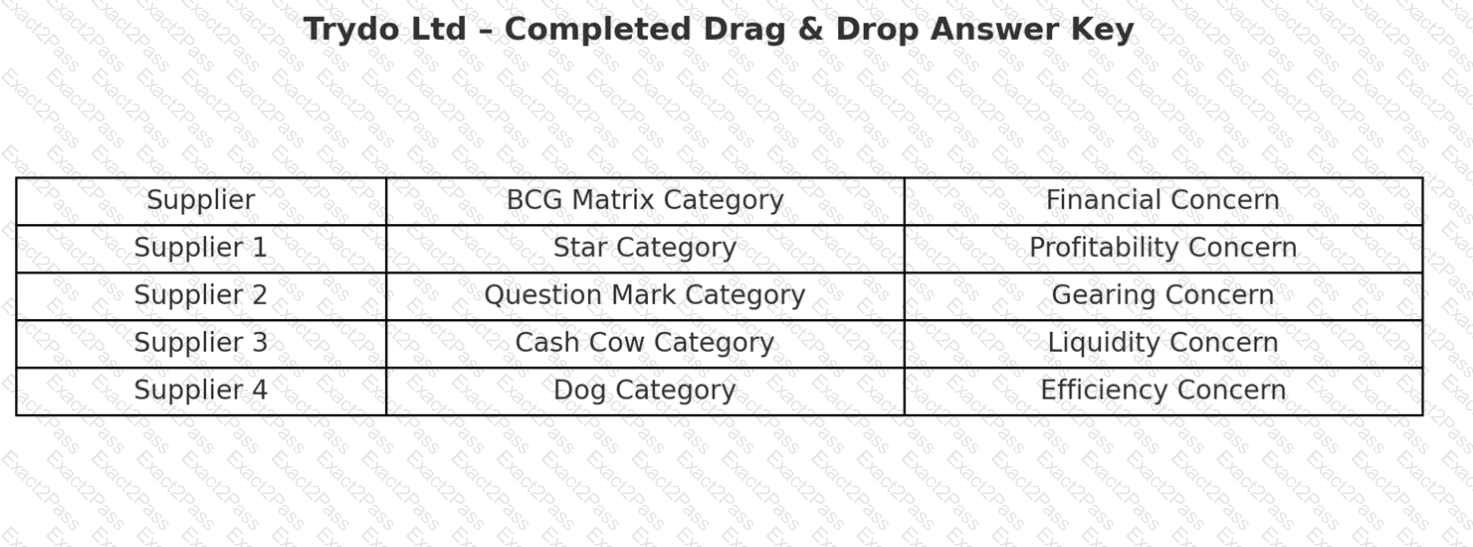

Supplier 1 → Star Category + Profitability Concern

Supplier 1 holds a large market share in a growing market, which places it in the Star category of the BCG Matrix. Stars are typically leaders in expanding markets and require continuous investment to maintain their dominance. The concern here is not competitive weakness but profitability. Although revenue potential is strong, Supplier 1’s costs have increased by 36% due to rising raw material prices. This erodes margins and threatens profitability despite growth. Stars often generate high cash inflows, but if costs spiral out of control, their ability to sustain investment weakens. Profitability management (e.g., through cost reduction, supplier negotiations, or efficiency gains) is critical to ensuring Supplier 1 continues its growth trajectory and avoids slipping into the “Cash Cow” or “Dog” quadrants in the future.

(Ref: CIPS L5M6 Study Guide, p.117 – BCG Matrix application)

Supplier 2 → Question Mark Category + Gearing Concern

Supplier 2 operates in a fast-growing market but has only a small share, making it a Question Mark in the BCG Matrix. Question Marks are high-risk: they may grow into Stars or fail and become Dogs, depending on how they perform and whether investment supports expansion. The major financial concern here is gearing—Supplier 2 has taken out significant loans and a large mortgage, meaning it is heavily leveraged. High gearing increases financial risk, as debt repayments must be met regardless of market conditions. In rapidly growing markets, high gearing can restrict reinvestment and leave firms vulnerable to interest rate fluctuations or downturns. For Trydo, this means Supplier 2 could face difficulties sustaining its growth, posing supply chain risk. Monitoring debt levels and financial stability is essential before committing to long-term contracts.

(Ref: CIPS L5M6 Study Guide, pp.117–118 – Question Marks and financial analysis)

Supplier 3 → Cash Cow Category + Liquidity Concern

Supplier 3 operates in a small, stable market but commands a strong market share. This places it firmly as a Cash Cow—a business that generates consistent revenue without requiring major investment. Cash Cows fund other areas of a portfolio but face limited growth prospects. The concern here is liquidity. An Acid Test reveals that Supplier 3’s current liabilities are four times greater than its assets, suggesting it lacks sufficient short-term liquidity to meet obligations. This imbalance can result in cash flow problems, even if long-term profitability remains sound. For Trydo, the risk is that Supplier 3 may fail to pay debts or manage day-to-day operations, creating supply disruption. Procurement managers must ensure financial health checks are conducted regularly and consider diversification strategies if reliance on Supplier 3 is high.

(Ref: CIPS L5M6 Study Guide, p.117 – Cash Cows and liquidity issues)

Supplier 4 → Dog Category + Efficiency Concern

Supplier 4 operates in a shrinking market and already holds a low market share, placing it in the Dog category of the BCG Matrix. Dogs are generally unattractive, offering little growth and limited returns. The key concern here is efficiency. Supplier 4 is struggling with capital management issues, such as poor stock turnover and prolonged debtor days. These inefficiencies damage competitiveness and further weaken financial stability. For Trydo, relying on Supplier 4 poses significant risk because inefficiency can lead to delays, reduced quality, and increased total cost of ownership. Unless Supplier 4 improves performance, it may eventually exit the market, leaving Trydo vulnerable. In procurement terms, buyers should avoid long-term commitments with such suppliers and instead focus on exit strategies or alternatives.

(Ref: CIPS L5M6 Study Guide, pp.117–118 – Dogs and efficiency management)