Last Update 23 hours ago Total Questions : 345

The Microsoft Dynamics 365 Finance content is now fully updated, with all current exam questions added 23 hours ago. Deciding to include MB-310 practice exam questions in your study plan goes far beyond basic test preparation.

You'll find that our MB-310 exam questions frequently feature detailed scenarios and practical problem-solving exercises that directly mirror industry challenges. Engaging with these MB-310 sample sets allows you to effectively manage your time and pace yourself, giving you the ability to finish any Microsoft Dynamics 365 Finance practice test comfortably within the allotted time.

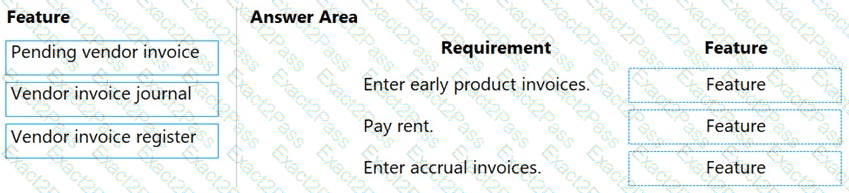

You need to configure the system to meet invoicing requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

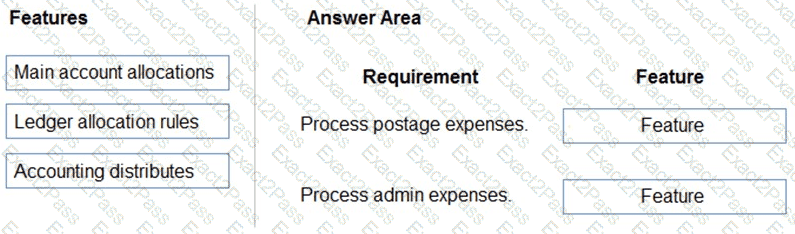

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or net at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

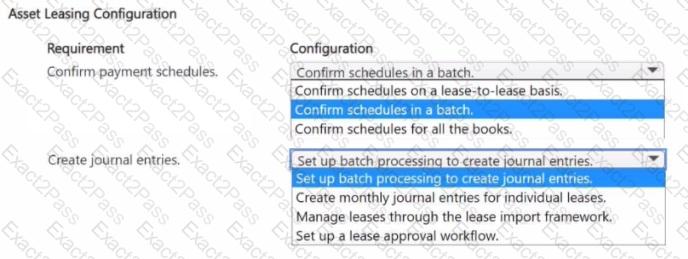

You need to resolve the issue related to monthly lease expenses.

How should you configure asset leasing? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

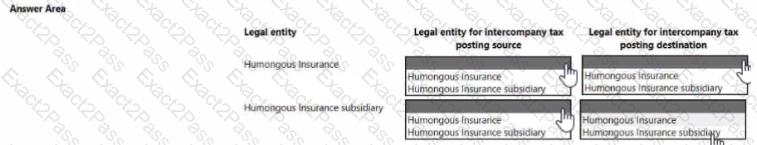

You need to configure expense management tor Humongous Insurance and its subsidiary. Which options should you use? To answer select the appropriate options in me answer area

NOTE: Each correct selection is worth one point.

You need to configure currencies for the legal entities.

configure currencies? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

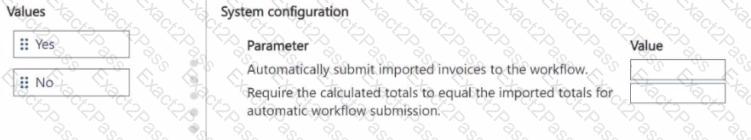

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to ensure the promotional gifts are posted to the correct account. What should you use?