Last Update 1 day ago Total Questions : 393

The Financial Strategy content is now fully updated, with all current exam questions added 1 day ago. Deciding to include F3 practice exam questions in your study plan goes far beyond basic test preparation.

You'll find that our F3 exam questions frequently feature detailed scenarios and practical problem-solving exercises that directly mirror industry challenges. Engaging with these F3 sample sets allows you to effectively manage your time and pace yourself, giving you the ability to finish any Financial Strategy practice test comfortably within the allotted time.

An unlisted company wishes to obtain an estimated value for its shares in anticipation of a private sale of a large parcel of shares.

Relevant data for the unlisted company:

• It has a residual dividend policy.

• It has earnings that are highly sensitive to underlying economic conditions.

• It is a small business in a large industry where there are listed companies but there are none with a similar capital structure.

The company intends to base valuations on the cost of equity of a proxy company after adjusting for any differences in capital structure where appropriate.

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

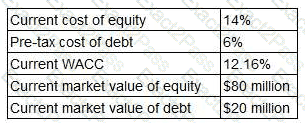

TTT pic is a listed company. The following information is relevant:

TTT pic's board is considering issuing new 6% irredeemable debt to re-purchase equity. This is expected to change TTT pic's debt to equity mix to 40: 60 by market value. The corporate tax rate is 20%.

What will be TTT pic's WACC following this change in capital structure?

Company U has made a bid for the entire share capital of Company B.

Company U is offering the shareholders in Company B the option of either a share exchange or a cash alternative.

Advise the shareholders in Company B which THREE of the following would be considered disadvantages of accepting the cash consideration?

A company needs to raise $40 million to finance a project. It has decided on a right issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $10.00 per share.

An unlisted software development business is to be sold by its founders to a private equity house following the initial development of the software. The business has not yet made a profit but significant profits are expected for the next three years with only negligible profits thereafter. The business owns the freehold of the property from which it operates. However, it is the industry norm to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value (CIV) method for this business?

A company's Board of Directors is assessing the likely impact of financing future new projects using either equity or debt.

The directors are uncertain of the effects on key variables.

Which THREE of the following statements are true?

A company based in Country A with the A$ as its functional currency requires A$500 million 20-year debt finance to finance a long-term investment The company has a high credit rating, but has not previously issued corporate bonds which are listed on the stock exchange Which THREE of the following are advantages of issuing 20 year bonds compared with simply borrowing for a 20 year period?